Economics is the study of how human beings allocate scarce resources among competing ends. The fundamental reality that economists recognize is that resources are scarce. That is, people desire more than is freely available.

Command vs. Market Economies

Because resources are scarce, everyone has to make trade offs. Once you devote resources to one thing, you can’t simultaneously direct them to a different activity. If you spend your time studying economics, you can’t spend that same time studying for something else.

Likewise, if you decide to build a skyscraper on your 1-acre plot of land, you can’t use the same land for a factory.

Economic systems establish the ground rules–who it is that gets to make the decisions about how our scarce resources are allocated. In general, there are two main types of economies: command economies and market economies. In a market economy, individuals allocate resources according to their own plans and information. You get to make the decision on what to study for the next 15 minutes. The landowner gets to decide what to build on their land, or they can sell it to someone else.

In a command economy, resource allocation is centrally planned by the state, who owns the means of production. State agencies or departments determine where factories should be built and how much of a given good or service should be produced. There are also mixed economic systems, which as their name suggests, try to mix the two kinds of economic systems together.

Characteristics of a Market Economy

A market economy is characterized by economic freedom and limited government. In a market economy, property and labor are privately owned, and the decisions to work and exchange goods and services are decided by individuals.

Voluntary exchange takes place whenever individuals are able to identify mutually beneficial gains from trade. The price system communicates to market participants the value placed on different resources, and individual ownership enables a multitude of transactions to take place without anyone centrally directing them. The government plays the role of establishing property rights and enforcing laws that set the ground rules for exchange and competition.

Competition

What emerges from a market order is an economy where competition identifies and rewards the best producers of a good or service with economic profit, and subpar producers are encouraged (via losses) to exit markets. In a market economy, competition is a feature, not a bug, of the system. Rather than unnecessarily duplicating the work of another firm, competition enables producers to experiment to discover new and better goods and services, or better methods of production for existing goods and services.

Because no one knows beforehand exactly what, or how, or where to produce every good or service, or how to devise even better products and methodologies, the market uses competition to continuously improve its allocation of scarce resources.

The Role of Profits and Losses

It is important to note that the incentives created by the price system, both profits AND losses, are a critical mechanism by which a market system operates. Profit is the reward for successful experimentation. It is the product of a company offering a more desirable good or service than available alternatives at a price point that covers the company’s cost of ALL of their used resources. This includes a company’s opportunity cost (whatever the value was of the next best alternative).

A company might be able to cover their accounting costs (their pure financial costs), but if they could have been producing something that was significantly more valuable with their time and effort, they missed an opportunity for economic profit.

Equally important in a market economy are losses. Losses are an important signal to producers that they are wasting resources; that is, customers do not value what they are doing more than the cost of inputs. As producers exit markets where they incur losses, resources are freed up to be used where they are more highly valued.

Market Allocation

Market allocation of resources includes all factors of production. Land, labor, capital, and entrepreneurial activity all have opportunity costs. When a resource is used for one purpose, it is then unavailable for an alternative use. Through markets, the value of these opportunity costs is made clear in the simplest manner possible (through a price) as buyers compete for a limited resource by bidding higher. No one has to know all of the potential uses for an item for the price system to allocate resources to those who value them the most.

Circular Flow Model

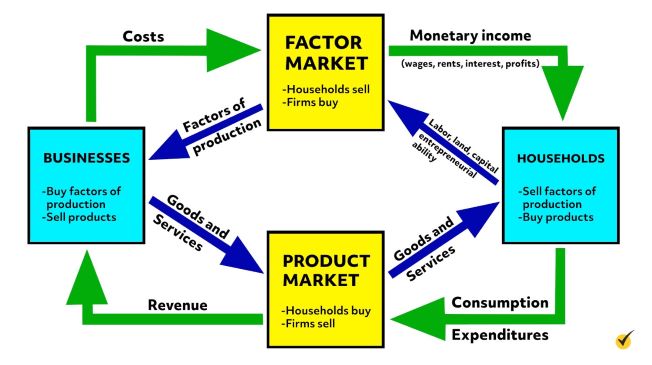

Economists use a diagram called the circular flow to explain how markets link two groups of economic decision-makers–households and businesses (oftentimes called firms). Households and businesses interact in two markets. In the first market, the factor market, households are the sellers of resources (land, labor, capital, and entrepreneurial ability), and firms are the buyers of these factors of production. Firms buy resources from sellers, and households receive payments for providing these resources.

Each type of payment has a different name. Payments for labor are wages. Payments for land or other natural resources derived from land are referred to as rents. Profit is what we call the leftover money after a firm has paid all its costs. This goes to the owner of the business. You may find it surprising that households own land, capital, and even entrepreneurial ability in this market. Households are modeled as owning all of these resources because, ultimately, each business is owned by individuals, or groups of individuals, who are themselves part of households.

When a firm makes a profit, the owner of the firm takes home the profit and gets to spend it however they choose. This brings us to the second market, the product market. In the product market, firms are the sellers of products, and households are the consumers. Households use the income they received for their land, labor, capital, and entrepreneurial ability to make purchases. Money flows to the businesses and products go to the households. The circular flow model shows how firms and households are interdependent on one another for money and resources.

Competition and Continuous Improvement

Note that the circular flow model groups all businesses together as a unit of economic decision-makers to show how money and resources flow through the economy. However, it is important to note that in a market economy these businesses do not function as one monolithic entity spitting out identical products that households buy robotically. These businesses are competing with one another in factor markets for resources and are continuously modifying their product offerings to compete for your dollars.

Households likewise are continuously comparing products and reallocating dollars to businesses that better meet their needs. And as necessary, households are updating where they sell their land and labor to receive better wages, rents, and profit. Competition, the market economy’s allocation method for scarce resources, is hard at work, continuously reorganizing resources for their best possible return. This competition in the market place is a continuous discovery process of how to meet consumers’ desires with limited resources.

Review Questions

Okay, let’s go over a few questions.

1. An increase in the price of land indicates:

- Land is less scarce.

- Land is more scarce.

- The price of land does not reflect relative scarcity.

Scarcity means that there is less freely available than is desired. Land is an example of a scarce resource. When the price of land goes up, that communicates to buyers that there is more interest in the resource than before; that is, more people want something that is limited in availability.

2. Which of the following would be most likely to happen if a government capped profits for businesses?

- Businesses would be more likely to stick with the same way of doing things.

- Businesses would be more likely to experiment with new production methods.

- Businesses would be more likely to increase output.

Profits are the incentive for businesses to try new ways of doing things. If their potential returns on experimentation are capped, they are more likely to continue doing something that they know is working.

3. In the circular flow model, businesses pay workers wages, which eventually flows back to businesses as:

- Rents for land

- Profit for entrepreneurial activity

- Payments for products

When households purchase products, they use their income (wages) to acquire goods. That transaction transfers money from households to businesses.

That’s all for now, thanks for watching and happy that you live in a free society!